Solving the Complexity of Pricing Hierarchy in Banking: Why Modern Systems are a Game Changer

August 12, 2025

Anishkumar Pillai

blog post

The Challenge of Pricing in Modern Banking

In today’s competitive and hyper-personalized financial environment, banks face growing pressure to offer tailored pricing across products, segments, and customer relationships. But with this flexibility comes complexity — and managing that complexity at scale is where most institutions stumble. At the heart of the issue lies the Pricing Hierarchy — a foundational component that determines how pricing is set, prioritized, and resolved across various dimensions. Yet, many banks still rely on static, siloed setups that make this process rigid, opaque, and error-prone.

What is a Pricing Hierarchy?

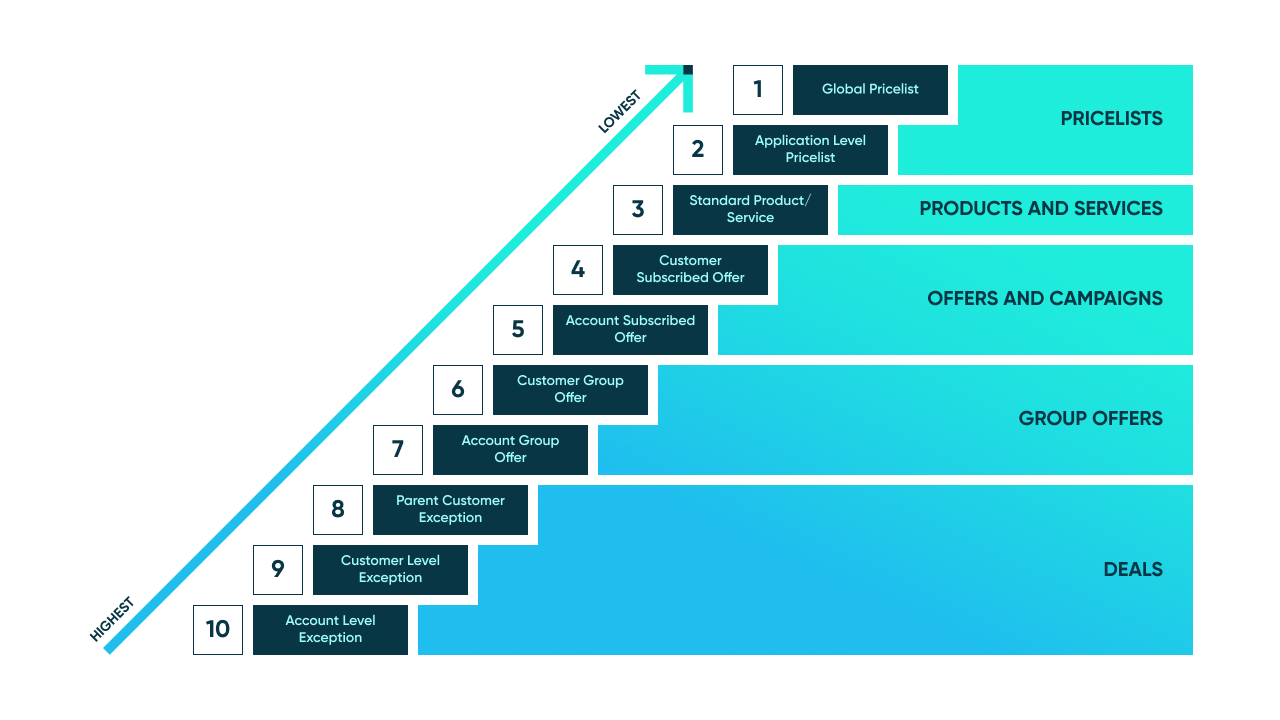

A Pricing Hierarchy is the framework that banks use to define how pricing rules are structured and resolved. Think of it as a layered architecture that might include:

- Standard pricing at a product or service level

- Segment pricing for specific customer groups

- Relationship-based pricing that offers bundled benefits across accounts

- Use Case: Relationship-Based Pricing for SMEs

- A leading regional bank wanted to deepen its relationship with SME customers. It offered bundled pricing across checking, lending, and treasury products — with discounts based on total wallet size and cross-product usage. With a modern pricing hierarchy setup, the bank could configure rules such that:

- Base pricing applied to each product

- A relationship discount was added if three or more products were active

- Additional tiered discounts kicked in based on monthly average balances

- When an SME opened a new loan, the pricing engine automatically applied the appropriate relationship discount based on current holdings, without any manual intervention. This led to:

- Increased product penetration per customer

- More predictable and transparent pricing decisions

- Reduced front-office dependency on manual approvals

- Negotiated pricing at an individual customer level

- Use Case: Exception Management for Corporate Clients

- A large commercial bank had negotiated bespoke pricing with hundreds of mid-to-large corporate clients. However, its legacy system couldn’t manage overrides cleanly, often leading to billing errors or lost margin.

- By implementing a configurable pricing resolution engine:

- Custom pricing rules were created per client, with precedence over standard pricing

- Exceptions had expiry rules and review cycles built-in

- Sales teams could request pricing exceptions via workflows that triggered approvals

- The result:

- 95% reduction in billing disputes from corporates

- Recovered revenue leakage worth millions annually

- Full visibility for compliance and audit teams

- Promotional or time-based pricing rules

- Use Case: Campaign-Specific Promotional Pricing

- A digital-first challenger bank launched short-term offers to attract new retail customers — zero-fee accounts and bonus interest rates for limited timeframes. Instead of hard-coding promo logic, they used the pricing hierarchy system to:

- Define promo rules with start/end dates

- Target specific customer segments (e.g., first-time depositors)

- Automatically expire rules post-campaign

- This gave them:

- Faster campaign rollouts (from weeks to days)

- Real-time visibility on uptake and profitability

- No operational burden of post-campaign clean-up

- Multi-Region Pricing with Local Customization

- Use Case: Global and Local pricing

- An international bank operating across Asia, Europe, and the Middle East needed a centralized pricing strategy with local adaptability.

- Using pricing hierarchy configuration:

- Core products had standard pricing globally

- Country-level overrides adjusted for local market conditions

- Relationship-based pricing added another layer based on region-specific thresholds

- This structure allowed the bank to:

- Ensure global consistency with local relevance

- Maintain compliance with local pricing regulations

- Launch global offerings with localized pricing levers

When multiple pricing rules apply, the system must resolve which one takes precedence — accurately and instantly.

Why Traditional Systems Fall Short

Legacy systems are often hardcoded and fragmented across lines of business. They typically lack:

- A unified pricing model

- Rule resolution logic that can handle overlaps and exceptions

- Real-time pricing impact analysis

- Traceability and auditability

The result? Inconsistent pricing decisions, lost revenue opportunities, compliance risks, and a poor customer experience.

How a Modern Pricing & Billing System Solves This

A next-gen pricing and billing platform changes the game by providing:

- Configurable Hierarchy Setup Banks can define pricing rules at any level — global, regional, product, customer segment, or individual. These can be layered to reflect real-world needs without re-engineering the system.

- Automated Resolution Engine The system intelligently determines the applicable price when multiple rules intersect, applying clear precedence rules. No manual overrides. No confusion.

- Audit and Trace Capabilities Every pricing decision is traceable. Banks can justify “why” a customer got a certain price — vital for compliance and customer service.

- Scenario Testing and Simulation Before launching a new pricing scheme, banks can simulate its effect on revenue and customer segments — reducing risk and optimizing impact.

- Real-Time Pricing Application In a digital-first environment, pricing decisions need to happen in real-time — whether it’s for a transaction, a loan quote, or a bundled offer.

Real-World Impact: From Friction to Flexibility

Banks that invest in a modern pricing hierarchy and resolution engine benefit from:

- Greater pricing agility to respond to market changes

- Improved customer satisfaction with personalized, transparent pricing

- Tighter control over discounting and revenue leakage

- Faster go-to-market with new products or campaigns

- Stronger compliance with auditable rule application

Conclusion: Pricing Hierarchy as a Strategic Asset

What used to be a backend headache is now a front-line differentiator. Banks that treat pricing hierarchy and resolution as a strategic capability — powered by the right system — can turn complexity into competitive advantage. A pricing hierarchy setup and resolution system is more than a technical tool—it’s a strategic asset that empowers banks to navigate the complexities of modern banking. By enabling personalized pricing, optimizing revenue, and ensuring compliance, such systems drive profitability and customer loyalty. As competition intensifies and customer expectations grow, banks that invest in advanced pricing and billing platforms will be best positioned to thrive in the digital era. The future of banking lies in delivering value-driven, transparent, and agile pricing experiences, and a robust pricing hierarchy is the foundation for achieving this vision. These cases show how a robust pricing hierarchy and resolution capability doesn’t just make life easier — it drives revenue, improves governance, and accelerates innovation.