It’s year-end, which means reviewing what went well in the past year, and ways to improve moving into another year. For most, that means making an assessment of what is working and what needs to be improved. We were recently reminded of a blockbuster high-level executive session, and wanted to remind our followers so they, too, can gain value in 2023.

A popular webinar provided earlier this year continues to deliver EOY ROI for bank martech teams. In “Drive Greater Profitability and Exceptional Customer Experiences with Personalized Offers,” Naehas CEO Rab Govil offers insights into the value of a benchmark assessment — to help banks gain a sense of where they stand compared to their industry peers, aka competition. It featured expert input from renowned finserv marcom leaders, from Forrester and Capgemini, discussing best practices for using personalized offers to deliver exceptional customer experiences.

Govil was joined by guest speaker Rusty Warner from Forrester, who shared strategic insights from his CX research and recent work with leading financial institutions. He was joined by Chandra Venkatesan from Capgemini, who discussed the hottest topics impacting financial services institutions today — from platform technology that helps banks cut cycle time to providing benchmark assessments to bank martech teams. Key topics included:

Govil was joined by guest speaker Rusty Warner from Forrester, who shared strategic insights from his CX research and recent work with leading financial institutions. He was joined by Chandra Venkatesan from Capgemini, who discussed the hottest topics impacting financial services institutions today — from platform technology that helps banks cut cycle time to providing benchmark assessments to bank martech teams. Key topics included:

- The value of personalized offers and delivering on the promise of the customer experience – in a timely fashion.

- Best practices for greater agility and speed to market without compromising on compliance and the goal of 100% accuracy.

- Change management and a best practice framework across technology, people and processes within your organization to enable personalized offers.

We’re bringing the webinar back for viewing, so tune in to get clear next steps to help make your journey to delivering personalized offers more successful, including how to take advantage of a complimentary benchmarking and readiness assessment!

Here’s an excerpt of what Naehas CEO shared about the value of benchmarking assessments:

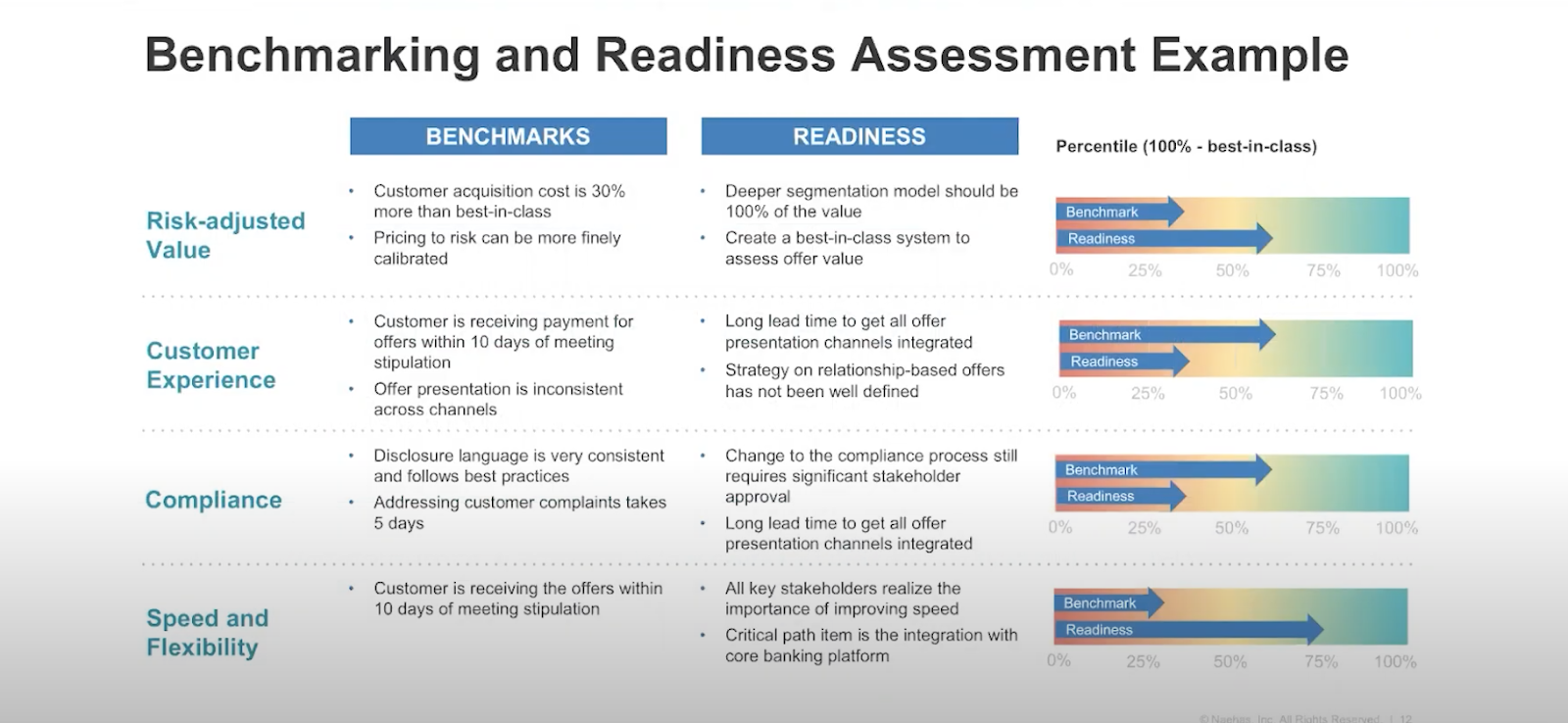

What we have now is the data where we are able to very quickly come in and evaluate an organization based on four different parameters. In the webinar, which can be viewed here, Govil and his expert panelists weigh in on key areas addressed in this tool.

Watch a summary of Govil’s comments in the video below, which focus on risk-adjusted value, customer experience, compliance, and speed and flexibility. He also noted the value that bank marketing teams gain from having a benchmarking assessment prepared to gauge where they are in the market, and how to improve.

How do you compare against other institutions in the same sector?

Finding out is easier than ever. We can identify important information. Are you in the 10th, 50th or 90th percentile? Are you pricing to risk properly calibrated? Is the customer receiving the payment within 10 days of meeting the stipulations? We can deliver a benchmark and tell you where you stand.

Looking at the still volatile market moving into 2023, there is no better time to connect with the Naehas solution team to optimize the opportunities that can emerge from a benchmarking assessment.

To watch the entire webinar visit https://info.naehas.com/webinar-drive-profitability-with-personalization-replay