Menu

Reduce regulatory risk by automating your marketing and service disclosures.

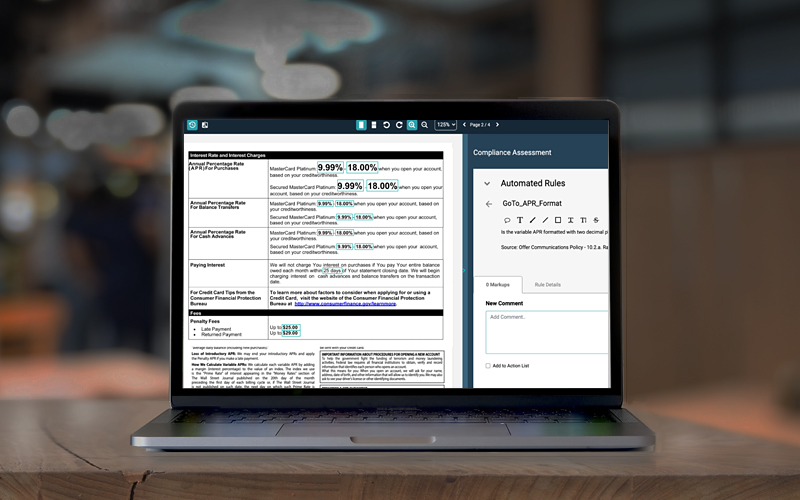

Naehas automates the creation of disclosures with a rules engine, quality assurance tools, and a compliance time machine to store the history of every disclosure for auditors and regulators.

When prime rate changes, you can make the change across all channels using our dynamic content, shared rules, and your offer matrix — all in just minutes.

With Naehas’ centralized platform, you no longer have to scour multiple places to find what you need. Whether it’s intro prices, APR rates, balance transfer expiration dates, or product codes, simply use the Naehas platform to access all the data values for your dynamic disclosures.

Respond to regulatory inquiries or fix an error quickly with our Traceability features.

Our automated quality assurance tools have reduced errors for our bank clientele by over 90%, and they can do the same for you, too.

3600 West Bayshore Rd, Suite 101

Palo Alto, CA 94303

4300 Commerce Ct, Suite 110

Lisle, IL 60532

Plot 270, Phase, 2, Udyog Vihar, Sector 20, Gurugram, Haryana 122016