With consumers increasingly demanding an exceptional digital experience from their banks, there is nothing more urgent for finserv marketers today than getting personalization right. Whether for banks, wealth management firms or fintech start-ups, campaign management success depends on meeting customers where they are, with what they want. Landing and expanding relationships, driving revenue, and reducing risk – all while staying laser focused on speeding time to market, are martech musts. To that end, finding partners who can collaborate to leverage cloud-based platforms becomes a critical marketing must. Establishing trust with those who have deep industry experience and follow best practices, with a focus on delivering personalized products, pricing and customer experiences, can yield powerful returns.

What matters most to the enterprise? As noted in the first article in this blog series, marketing execution teams managing personalized offers are focused on three key goals:

- Better Outcomes

- Higher Efficiency

- Customer Experience

In this highly-regulated industry, the complexities of compliance and risk management make the need for impactful personalization even greater. We regularly see clients coming to us with similar vexing challenges.

Common Pain Points of Personalization:

Unable to create offers to bundles (multi-product)

Unable to create offers to bundles (multi-product)- Inability to offer relationship-based dynamic pricing

- Disjointed, manual processes lead to long time to market

- Error-prone processes with long payment cycles (30-45 days)

- Highly-manual processes with no visibility into customer status

- Extremely slow customer care/customer resolution

Job #1: Personalization Prioritization

For mission critical support, considering a Customer Experience Cloud for financial services offer management programs can be a vital step to greater personalization and profits.

Collaborating with financial service industry marketing leaders is nothing new for our team, and that starts at the top. Naehas CEO, Rab Govil, recently facilitated a high-level discussion which included respected leaders in digital transformation and customer experience. Representing decades of proven expertise, these DX and CX thought leaders, from Capgemini and Forrester, joined with Rab to share the powerful ways prioritizing personalization delivers top results. Staying competitive, and staying compliant require finserv martech leaders to lean into these proven, top-performing platform technologies that consistently keep leading institutions on top of the fiercely competitive financial services industry.

That valuable webinar discussion was repurposed into a resourceful Q&A and blog series we created. It offers highlights from that high-level discussion, including ways to meet the challenge of driving growth with platform technology. You won’t want to miss the actionable insights our leader and these collaborative partners share in these and other high-value resources.

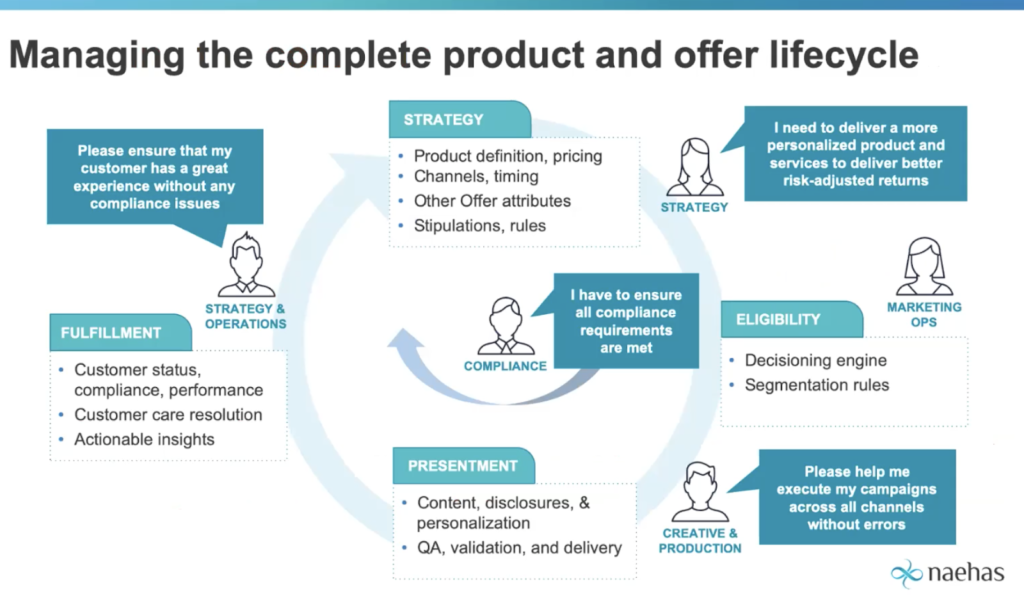

In the DX for CX discussion, Govil noted essential components of personalization success.

“Offer strategy, marketing strategy, marketing operations, presentment processes, and collaboration among all teams to ensure fulfillment is happening appropriately, on an almost real-time basis,” said Govil. He added, “In the middle, you have compliance. As we are increasing velocity of offer creation and delivery, and personalization, it’s essential to make certain that compliance teams feel comfortable that all of the changes are appropriate, so they do not serve as a speed rail.

You cannot scale without having some level of automation from an auditing capability. There needs to be a seamless review between teams with a compliance assessment. If you’re going to scale, you need automation powered by AI to help review the compliance component.” – Rab Govil, CEO and Founder, Naehas

Proven Platforms + Trusted Partnerships = Success

Strategic partners are force multipliers for financial service institutions. Chosen carefully, they bring industry leadership, hard-earned, value-added experience, and fundamental support to help a bank offer management and operations team answers to their most complex problems, and address their customer’s needs. Proven strategic partnerships bring value, reduce risk and serve financial services institutions of all sizes with an experience base and perspective. This expertise is a powerful asset to leading financial service institutions who have been well-served by the relationships and trust built by a “been there, done that” network of solution providers.

In such a highly-regulated industry, it is essential that software platform partners offer proven performance of their ability to help compliance and legal teams ensure accuracy and compliance rules. Applying a trusted partner’s automated solution set will help an institution’s offer management teams to execute offers more quickly with 100% regulatory compliance.

Criteria for Vendor Success: Requirements Checklist

Meeting the myriad requirements inherent in offer management is daunting, but doable. The process of finding partners who answer your institution’s needs can benefit from a thorough review of who can handle the complexities. If your marcom team finds itself needing “a little help here,” consider an Offer Management Requirements Checklist to secure a sense of confidence moving forward.

Developed as a one-stop guide to securing a solutions provider, the Checklist covers 50+ success criteria factors which marketers and their vendor partners face through the process.

As 2022 promises to bring a continuing focus on customer-centric marketing, gaining a competitive edge, mitigating risk, increasing time to market and embracing change will all be critical cogs in the wheel of successful bank marketing initiatives. Staying informed and innovative is essential for those readying to best automate regulatory compliance, while growing relationships and revenue in the challenging months ahead. Bank marketing teams who equip themselves with the proper tools, technology and partner teams to face the complex regulatory landscape are poised for long-term growth. Here’s to prioritizing personalization and leveraging platform technology that delivers relationships and revenue.