A recent McKinsey article warns incumbent banks that they need to take bold action to turn the tables on digitally driven disruptors. One critical opportunity for competitive advantage is personalization, leveraging the vast wealth of customer data that consumer banking, wealth management and payments companies have at their disposal.

The trouble is that marketing strategists and their teams are often overwhelmed by the sheer volume of business rules and regulatory compliance standards that govern customer offers and terms, as well as the frequency of the changes to those rules and standards. What’s more, access to critical customer data is often stored in disparate, inaccessible legacy systems.

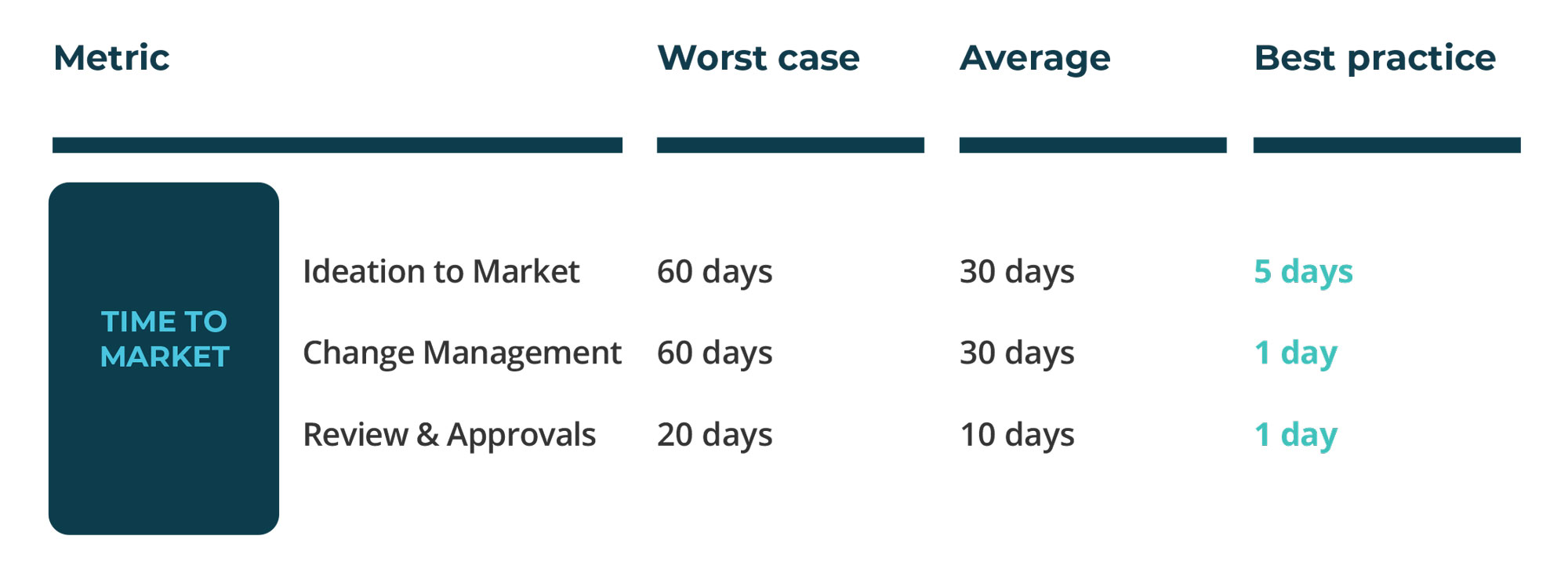

From concept to launch, we looked at how long it typically takes big banks to launch new product offers to their customers – and how much this process can be accelerated with modern AI-driven offer management platforms.

Traditional Offer Management Speedbumps

Every day, financial services marketing strategists and their teams face the daunting task of promoting products to a diverse group of customers, while trying to break through the noise of the constant information overload that consumers experience. At once, marketers need to ensure that these offers:

- Are sufficiently personalized to demonstrate that a bank understands a customer’s evolving needs

- Offer dynamic pricing incentives for customers who subscribe to multi-product bundles

- Resonate with customers across multiple channels like direct mail, email, ATMs and social media

- Meet ever-changing regulatory compliance standards that govern personal privacy, customer offers and terms

- Don’t encounter fulfilment or eligibility challenges when customers try and accept an offer

- Are engaging enough to rise above the buzz created by digital disruptors

Marketers are equally vexed by having to juggle multiple spreadsheets and disparate data sources to better target and personalize offers, as it is a tedious, time-consuming, and error-prone process. Without unified systems or powerful analytics tools to extract important customer insights from legacy systems, marketers lack the tools and regulatory insights they need to create relevant, timely offers that effectively serve consumer needs.

The impact is that multiple services cannot be bundled, and customers cannot receive dynamic pricing offers based on their loyalty and how long they have been working with the bank. Relationships become strictly and singularly transactional in nature, and clients feel more like numbers on a spreadsheet than valued customers. And, without AI-powered tools to aid marketers in the design, creation, and QA of offers for services like lines of credit or investments, offer development processes are often slowed to a crawl by “analysis paralysis” – or campaigns that end up DOA with marketing operations or compliance colleagues.

As a result, Naehas benchmarking studies have found that it can take an average of 30 days to launch personalized offer campaigns – and up to 60 days in worst case scenarios. Institutions mired in these legacy processes and technologies risk losing market share to their digitally evolved competitors. Naehas studies also reveal that financial institutions that continue to create offers with legacy systems experience up to 20% lower client retention rates and achieve up to 6% lower offer acceptance conversion rates.

Getting to Market Up to 12X Faster with Modern Offer Management

Thanks to new AI-powered technologies, it’s becoming possible to deliver relationship-based offers from conception to launch, in record time, and with less risk and assured compliance. And it

could be easier than you might think. Four of the top five financial services companies, as well as regional banks such as First National Bank of Omaha, have modernized their offer management practices through streamlined processes and Naehas’ advanced AI technology platform.

So, how much faster can these organizations launch personalized offer campaigns? Our benchmarking studies have demonstrated that best-practice offer management with Naehas’ technology platform can get to market from 6x to 12x faster than legacy approaches.

What’s more, Naehas has seen financial services firms that modernize their offer management processes become positioned to upsell three times as many (or more) financial products to their customers. Their customer service teams address offer inquiries in near real-time, and they often accelerate client payments by 40 days.

Want to learn more? This eBook has the answers.

Download a free copy of “Modernizing Offer Management: Maintain a Critical Edge in the Digital Age.” In it, we describe how new perspectives and new technologies can create strategic opportunities for financial institutions – including recommendations for process optimization and case studies of financial services organizations who are successfully modernizing.