Marketing communications professionals in financial services need to comply with a vast array of government and industry-specific regulations. Review of regulated content involves a manual, error-prone, time-consuming review process across a small army of marketing compliance, legal and risk management teams. The cost of compliance is reflected in companies’ bottom lines, both directly, and in time-to-market delays due to complex, lengthy manual review cycles. Organizations cannot afford anything that slows time to market or limits the number of marketing efforts to grow their business. The need for speed is real.

In banks, insurance, wealth management, and fintech organizations, savvy martech leaders are increasingly turning to innovative industry-specific solutions to drive better processes and profits. Confidence is critical, and trust is of utmost importance when selecting vendors who collaborate with marketing, legal, compliance, IT and digital services teams across the enterprise.

Not all technology is created equal, and with so many options from which to choose, selecting partners with deep industry knowledge of regulations and disclosures carries risks and rewards. Learning what options are available in such a fast-paced, competitive market is not always easy.

Multi-tasking, overwhelmed marketers are simultaneously focused on many top priorities. Marketing compliance, and finding ways to drive efficiencies and accuracy, are chief among them.

Multi-tasking, overwhelmed marketers are simultaneously focused on many top priorities. Marketing compliance, and finding ways to drive efficiencies and accuracy, are chief among them.

When the selection process allows martech staff to identify the solution team that best understands their unique needs, the results are measurable and sustainable. Once those automation tools successfully support the enterprise’s compliance goals, other use cases emerge, creating a strong marketing force multiplier. What’s driving these solutions in the market today? AI. Here’s why.

This summary of ways automation – specifically addressing marketing compliance needs – does the heavy lifting, and for whom, should bring relief. Here’s a look at the why behind AI.

With myriad case studies in success, helping banks, wealth management teams and insurance companies achieve impactful efficiencies, Naehas is proud of its track record of automating reviews. Naehas Intelligent Reviews becomes a trusted assistant that leverages Artificial Intelligence to help accelerate the review process, achieve more efficient collaboration, and ensure more accurate customer communications.

Spotlight on Marketing Compliance Solutions

Who does it help?

The leading industry cloud solution becomes an assistant for a range of enterprise team members who work to ensure all regulatory compliance rules are met.

- Marketing Strategists

- Accelerate getting campaigns and offers out the door

- Marketing Ops Managers

- Reduce back-and-forth revision cycles caused by different interpretations

- Compliance Teams

- Define and centralize compliance rules to drive greater consistency and accuracy

- Legal Teams

- Reduce the time legal teams must devote to review and approval

How does it help?

Four core benefits are realized by organizations looking to solve high priority issues:

REDUCES RISK

by reviewing more content with greater accuracy

INCREASES PRODUCTIVITY

by reducing review cycle times and enabling more content and offers with confidence

DRIVES CONSISTENCY

by having a comprehensive rules-based assessment that guides your review and approval process

IMPROVES AUDITABILITY

by centrally managing all evidence in one source of truth thereby supporting credible challenges

How’s it actually work?

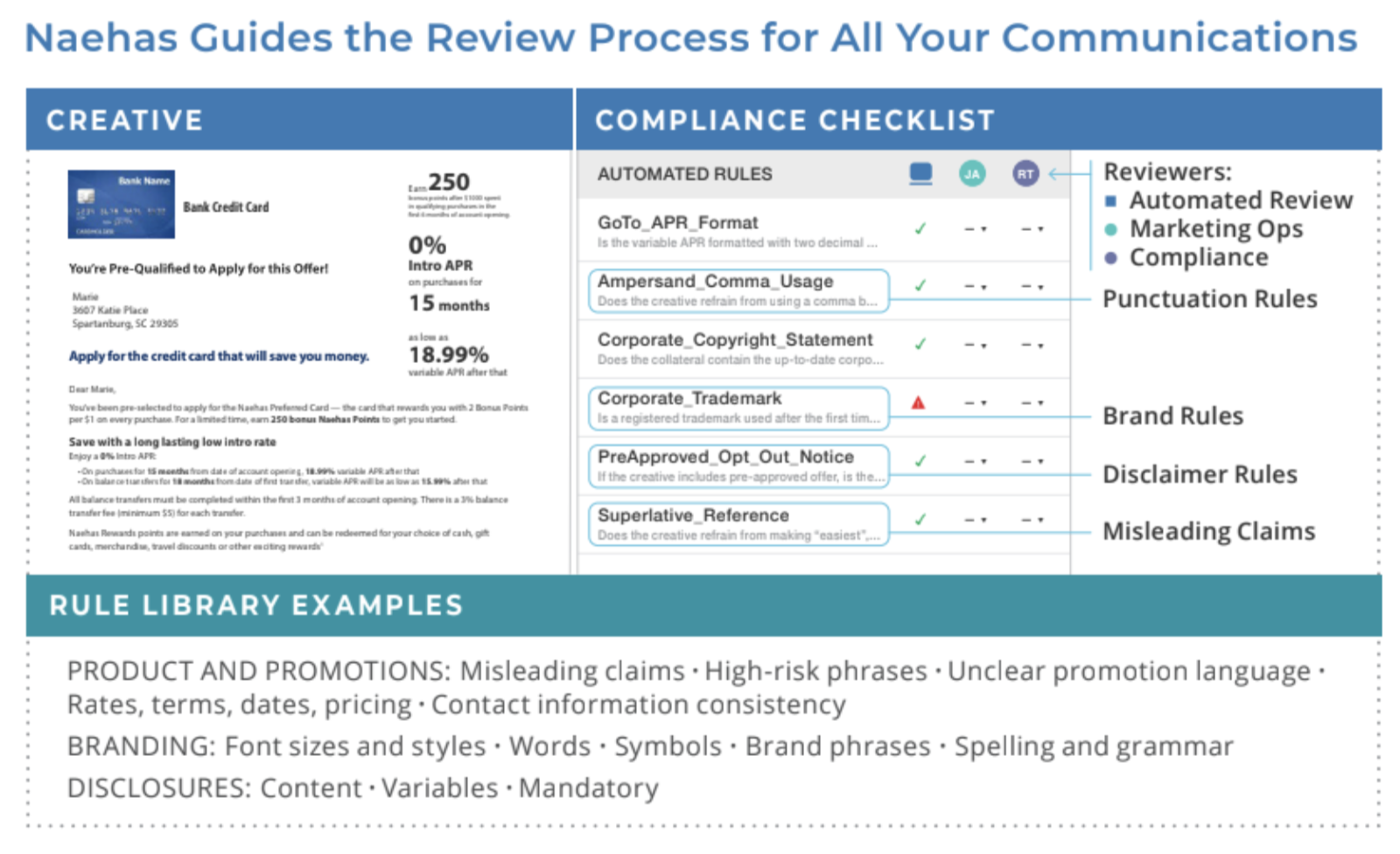

Through a set of predefined industry rules combined with an organization’s custom rules, Naehas Intelligent Reviews acts as an online assessment tool that accompanies every piece of marketing communications and provides greater consistency and accuracy across the entire marketing review cycle. With Naehas, institutions can get offers and other communications out the door faster, and talented marketing, compliance, and legal teams have more time to advance more pressing and valuable work.

Five features of Naehas Intelligent Reviews platform technology include:

AUTOMATED DOCUMENT ASSESSMENT

Run reviews of every pertinent piece of marketing collateral leveraging AI to identify any issues with language, claims and promotions; required disclosures; specific rates and terms; brand guidelines; contact information and other compliance issues.

RULE LIBRARY

Provide one location for all your general compliance and product-specific rules (i.e. pre-paid, credit card, deposits, etc.), as well as all past reviews of your documents and disclosures.

COLLABORATIVE REVIEW MANAGER

View and flag issues and any changes that need to be made (factors such as mandated fonts, proper disclaimers, misleading claims or promises, etc.). Show all change requests tied to specific rules by each reviewer.

COMPARE AND CHANGE VIEWER

See the changes made during each review cycle and confirm that only the required changes have been made. Eliminate tedious “corner-to-corner” reviews between rounds.

AUDIT HISTORY AND SECURITY MANAGER

Produce a secure, detailed audit trail to address any credible challenges needed and generate a meticulous history of all changes along with who approved them. Manage document access through customizable user security to each document.

Understanding the tech innovations available today to the financial services industry helps marketing, operations, digital services, legal and risk management teams make better decisions. The overview of this purposely-built cloud solution is our way to help bring resources to those doing the daunting work of regulatory compliance in a highly-competitive arena.

When you identify your primary needs, and zero in on potential solutions, be sure to ask specific questions and take advantage of demonstrations that reinforce the value of the vendor’s tools.

What to ask?

Here are some important questions to drive the selection process:

- Does the platform optimize, automate, and deliver greater control over the entire offer lifecycle – from strategy to fulfillment?

- Can it help manage people and tasks?

- Will it be able to send notifications to teams when changes occur or require additional review?

- Does it have the capacity to collect documents and information in one place for easy reference?

Companies eager for a competitive edge in the financial services industry will increasingly leverage platforms and partners which understand their needs. Taking time to understand the options available is critical to realizing operational and financial gains.

As regulatory compliance, risk management, governance and transparency continue to be key focus areas, marketing teams who position themselves with innovative partners are best positioned to get and stay ahead.

As regulatory compliance, risk management, governance and transparency continue to be key focus areas, marketing teams who position themselves with innovative partners are best positioned to get and stay ahead.

Automation, through Artificial Intelligence and Machine Learning, is a powerful driver of productivity and profits in financial services institutions.

The four key benefits of automated content review – reducing risk, increasing productivity, driving consistency, and improving auditability – are game-changers for banks, wealth management firms, fintech start-ups and insurance companies.