The promise of digital and omnichannel banking has been on the lips of financial services companies for nearly a decade. But the pandemic has brought with it an increased digital imperative and accelerated change in the process. Consumers are increasingly banking online and digital sales for banks have spiked. That said, as Deloitte notes in its 2021 outlook, “keeping customers satisfied, retaining them for the long haul, and gaining a greater share of wallet may still be as daunting as ever.”

Researchers, key opinion leaders and industry executives all agree: the key to capitalizing on and sustaining the opportunity with customers is personalization using targeted offer and engagement strategies.

Banks and other financial institutions that are growing with the best efficiency ratios have learned to deliver personalized offers to both existing customers and new business prospects. The more effectively they can get these offers to the right people at the right time with the right message and in full compliance with regulatory requirements, the more successful they are in achieving their revenue generation objectives – lifting annual revenue as much as 10%, according to research from the Boston Consulting Group.

Consumers Crave Personalization

The importance of cross-selling to current customers has become even more of a priority. As we noted in a previous post, targeting a current customer has a 60-70% chance of converting, whereas the likelihood of converting a new customer is just 5-20%. According to another study, 80% of future profits will come from 20% of existing customers.

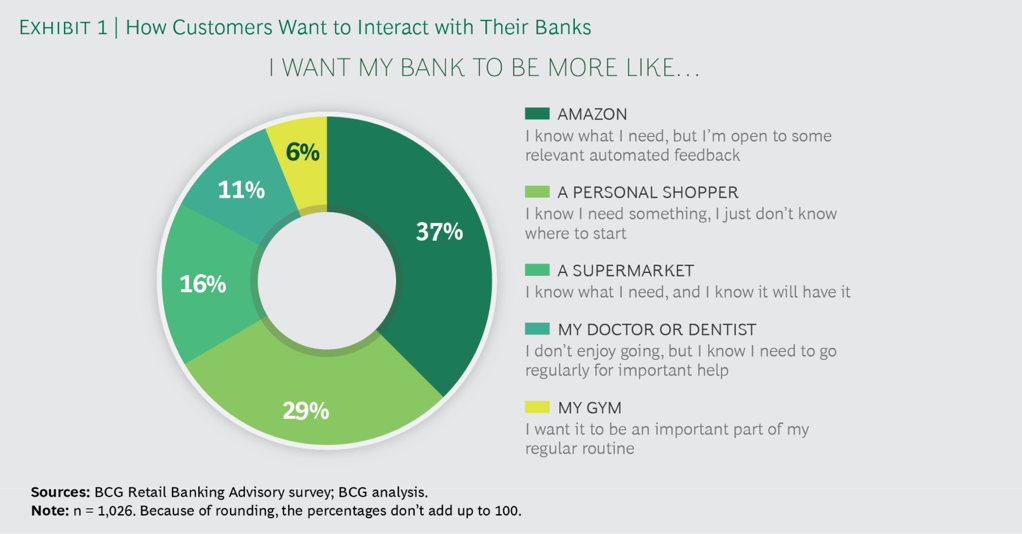

What’s more, personalization is actually something customers say they want. When asked how customers want to interact with their banks, one BCG retail banking survey reveals that 66% of customers want their banks to be more like Amazon or a “Personal Shopper”; consumers are not only open to suggestion from their financial services partner, they often seek it.

The challenge for incumbent brands in these industries – who often operate with legacy data and technology systems and are subject to intense regulatory scrutiny – is how exactly to unleash their own versions of customer obsession in the ways that an Amazon does. This kind of personalization, with speed and at scale, requires the integration of disparate customer data along with updated regulatory guidance and AI-driven analytics that provide complete, actionable customer snapshots and generate relevant offers. Thankfully, a new wave of modern offer management platforms is taking root.

The Keys to Personalization and Modern Offer Management

A modern enterprise offer management platform enables banks to gather timely, personalized data about their customers and better understand their needs and behaviors. It allows financial services providers to navigate beyond regulatory compliance obstacles and streamline or automate approvals. And it helps banks and insurance companies send the right offers, to the right clients, at the right time.

The right platform solution both addresses and improves upon each of the many challenges inherent in offer management. The result: a more efficient, effective process, and an overall better customer experience. The ROI: expanded relationships, increased revenue.

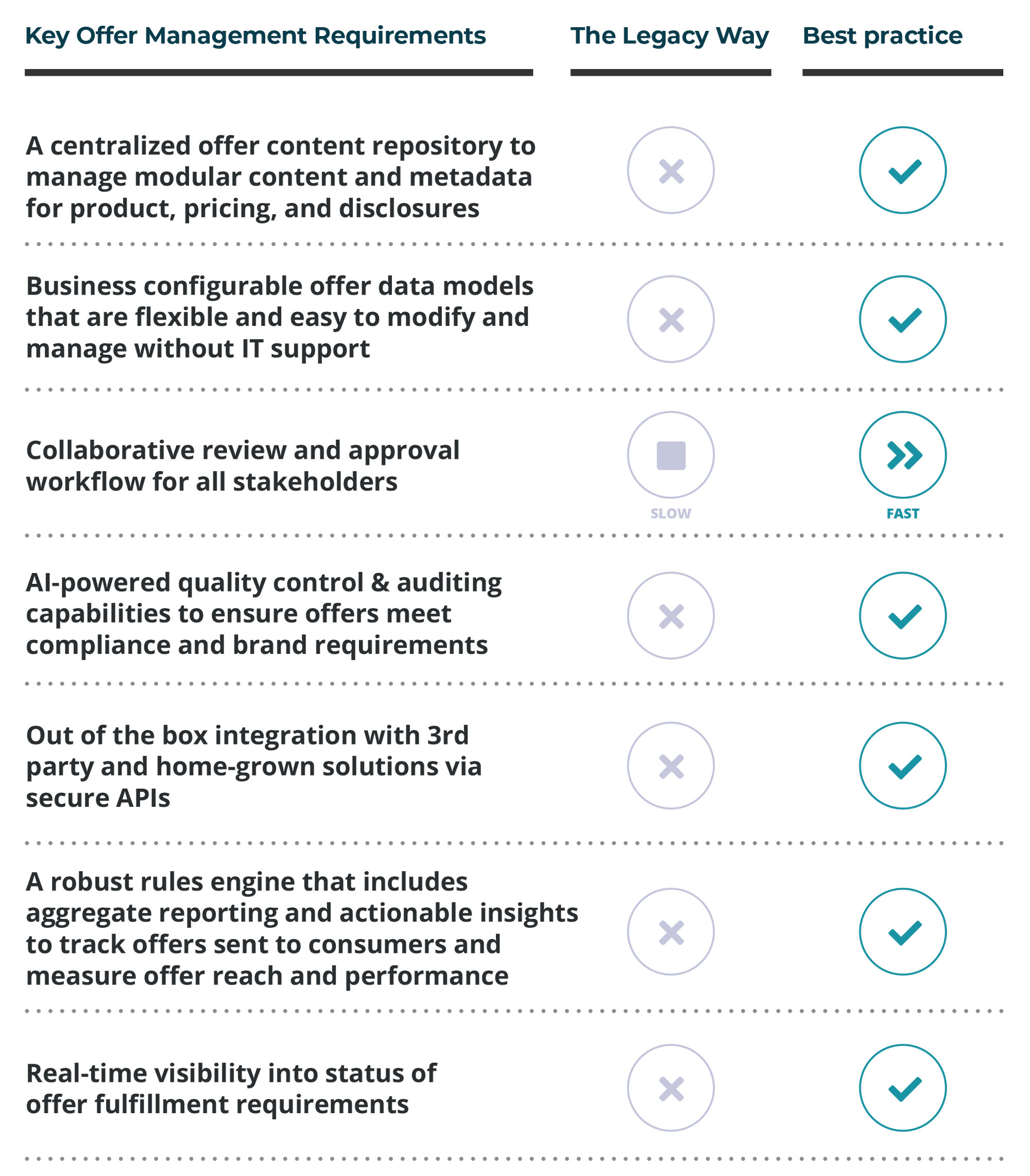

Below is a helpful guide that outlines the essential offer management requirements enabled by modernized systems, compared to the restrictions that apply to legacy systems. You can use this to help evaluate technology platforms and partners and to chart your path to personalization.

Want to learn more? This eBook has the answers.

Download a free copy of “Modernizing Offer Management: Maintain a Critical Edge in the Digital Age.” In it, we describe how new perspectives and new technologies can create strategic opportunities for financial institutions – including recommendations for process optimization and case studies of financial services organizations who are successfully modernizing.