Table of Contents

What is Schumer Box?

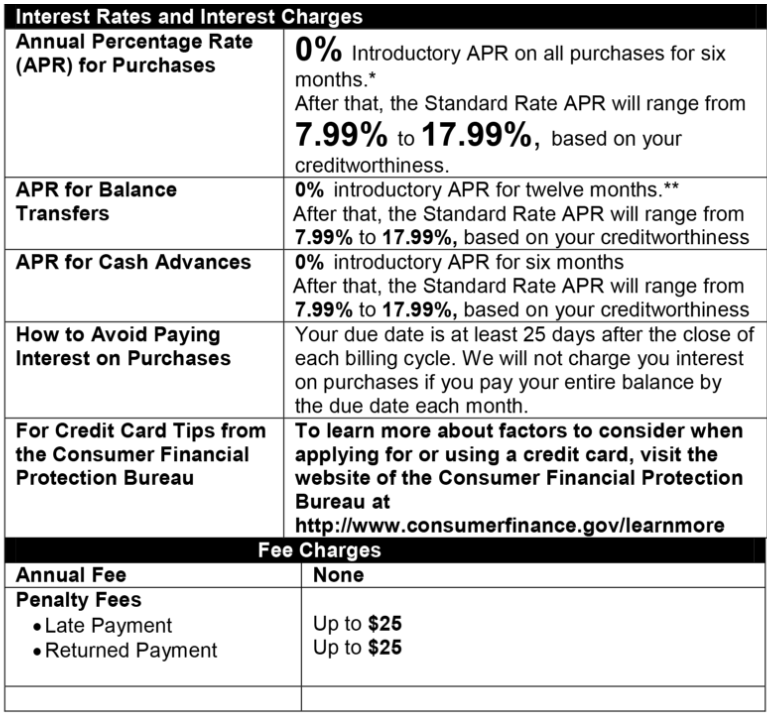

A Schumer Box refers to an easy-to-understand table that discloses fees, interest rates, terms and conditions of a credit card agreement.

A Schumer Box refers to an easy-to-understand table that discloses fees, interest rates, terms and conditions of a credit card agreement.

The table contains the required details of credit card agreements, including the annual percentage rate (APR), variable-rate information, grace period, annual fee, balance transfer fee, cash advance fee, late payment fee, foreign transaction fees, and minimum finance charges.

The purpose of the Schumer Box is to provide consumers with a simple way to review the rates and fees on a specific credit card so they can compare credit card offers and make an educated decision about which card to select.

The use of a Schumer Box by all U.S. credit card companies is required under the federal Truth in Lending Act (TILA).

The Schumer Box requirements apply to offers and credit card statements.

History of the Schumer Box

History of the Schumer Box

The Schumer Box owes its name to Chuck Schumer, a congressman and later senator from New York, who in 1988 pushed for landmark consumer protection legislation mandating that rates, fees and other terms on a credit card be prominently identified on credit card offers. The legislation was enacted in 1988 but did not take effect until 2000.

All credit card companies must print:

- long-term rate information in 18-point type or greater

- remaining terms in at least 12-point type.

Key information

Several pieces of information are required to be disclosed within a Schumer Box including:

- Annual percentage rate (APR) for purchases – the interest rate you pay on financed purchases, which may include introductory and long-term rates. Most credit cards use variable rates, indicating they can fluctuate based on changes in the Federal Reserve’s Prime Rate

- Other APRs – interest rates for balance transfers, cash advances, default, etc.

- Fixed/Variable Rates – When identifying APRs, it must be disclosed if they’re fixed or variable interest rates.

- Grace period – the exact time in days that a cardholder has to repay their balance before interest is charged

- Finance calculation method – how interest is calculated if the credit card balance is not paid in full each month

- Finance charges – the minimum amount charged if a balance is carried over month to month.

- Annual fee – the once-a-year charge for using the card

- Other fees – foreign transaction fees, balance transfers, cash advances, late payments, etc.

- Credit Card Tips from the Consumer Financial Protection Bureau – link to a resource page from the CFPB where consumers can find more information on safe credit card use. http://www.consumerfinance.gov/learnmore.

Example of the Schumer Box: